What Is the Difference Between Deferred Revenue and Unearned Revenue?

Use ‘unearned revenue’ in a Sentence

Unearned sales revenue is largest in the January quarter where most of the large enterprise accounts buy their subscription services. Revenue in Salesforce consists of billing to customers for their subscription services. Most of the subscription and support services are issued with annual terms resulting in unearned sales revenue. month when the last portion of the payment will be recognized as revenue. Image from Amazon Balance Sheet – Check out CFI’s Advanced Financial Modeling & Valuation Course for an in-depth valuation of Amazon.

It is important to understand that while analyzing a company, Unearned Sales Revenue should be taken into consideration as it is an indication of the growth visibility of the business. Higher Unearned income highlights the strong order inflow for the company and also results in good liquidity for the business as a whole. Furthermore, unearned income doesn’t result in cash outflow in future as only Unearned Sales Revenue, a liability, on the Unearned Sales Revenue Balance Sheet, is reduced as revenue is recognized on providing the goods or services proportionately.

This is known as unearned revenue or deferred income accounting. This is why What is bank reconciliation is recorded as an equal decrease in unearned revenue (a liability account) and increase in revenue (an asset account). unearned revenue This makes sure the equation continues to balance. Here’s an example of a balance sheet. Unearned revenue is a current liability and is commonly found on the balance sheet of companies belonging to many industries.

The rest is added to deferred income (liability) on the balance sheet for that year. If advance payments are made for services or goods due to be provided 12 months ormore after the payment date, then they will be recorded as long-term liabilities on thebalance sheet. For example, a real estate company accept payment of property rent for18 months in advance. The payment amount of $27,000 will be recorded under cash,increasing the assets, and under unearned revenue, increasing long-term liabilities. Airline carriers, for example, will have unearned revenue when they sell tickets beforethey deliver the service.

Is Unearned Revenue a Liability?

There may be instances when payment is collected, before revenue can be recognized. In these situations, unearned revenue must be reported to remain compliant with U.S. Generally Accepted Accounting Principles.

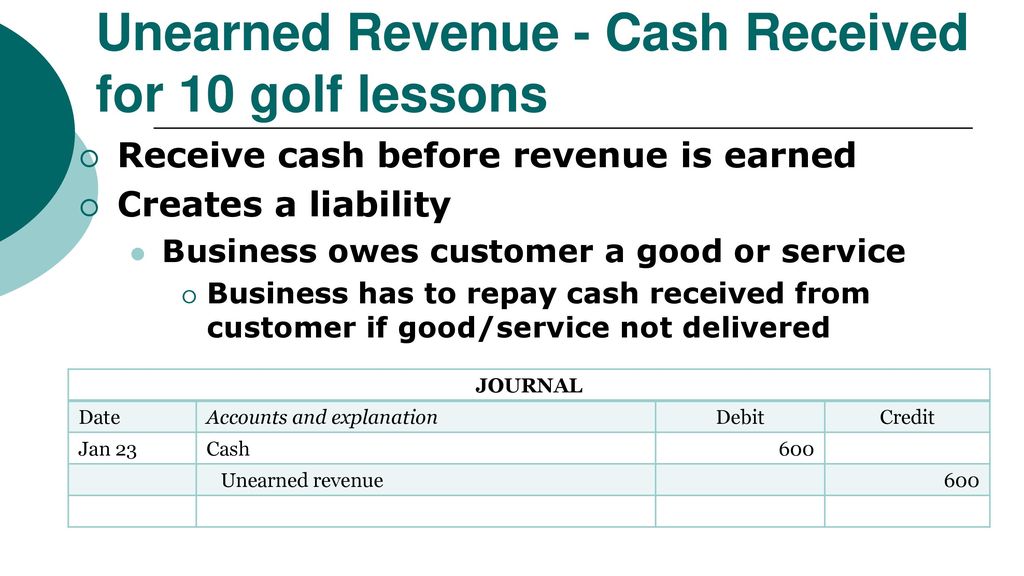

Unearned revenue arises when payment is received from customers before the services are rendered or goods are delivered to them. According to revenue recognition principle of accounting, the unearned revenue bookkeeping is not treated as revenue until the related goods and/or services are provided to customers. It is classified as current liability and is shown in current liabilities section of the balance sheet.

I associate unrecorded revenue with revenues that were earned, but not yet recorded in a company’s accounting records. For example, an electric utility will provide electricity to customers for up to one month before it reads the customers’ meters, calculates the unearned revenue bills and records the billings as revenues and accounts receivable. As a result, the electric utility will have up to one month of unrecorded revenue. At each balance sheet date, the utility should accrue for the revenues it earned but had not yet recorded.

- Accrual revenue – revenue is recognized at the time of the provision of services,performance of work, or transfer of goods.

- This means that they do not need to have considerable capital before being able to sell something to the buyers.

- As a result of this prepayment, the seller has a liability equal to the revenue earned until the good or service is delivered.

- Here’s an example of a balance sheet.

- A liability is defined as a company’s legal financial debts or obligations that arise during the course of business operations.

The money shows up as a liability on the balance sheet, because the company has possession of money that it hasn’t earned. Unearned revenues occur when companies follow the accrual https://www.bookstime.com/ basis of accounting. When advance payments are received for products or services that will be delivered or completed in the future, the earnings process is not complete.

The financial accounting term unearned revenue refers to revenues received in advance of rendering a service or providing goods to customers. Suppose a customer pays $1,800 for an insurance policy to protect her delivery vehicles for six months.

A liability is defined as a company’s legal financial debts or obligations that arise during the course of business operations. Deferred revenue is an advance payment for products or services that are to be delivered or performed in the future.

products, merchandise or services are exchanged for cash or claims to cash (realized) or when an asset received is readily converted into cash (realizable). Service providers are another example of businesses that typically deal with deferred revenue. For example, when you hire management accounting a contractor to renovate your house, the contractor generally wants at least some of the money up front. That money should be accounted for as deferred revenue until the job is complete — although the contractor can certainly use it to buy supplies to complete the job.

This concept also applies for customers who put down deposits on sales. Unearned revenue is usually disclosed as a current liability on a company’s balance sheet. This changes if advance payments are made for services or goods due to be provided 12 months or more after the payment date. In such cases, the unearned revenue will appear as a long-term liability on the balance sheet.

If, for whatever reason, the company is unable to deliver the goods or services as promised, the deferred revenue must be refunded. In this episode, we discuss the flow of accounting from how our journal entries are recorded in the general ledger, summarized in the trial balance, and then presented on the financial statements and tax returns. The “deferred payment” situation occurs when the seller delivers goods or services before the customer pays. The prepayment situation occurs when customers pay before receiving goods or services.

When the business provides the good or service, the unearned revenue account is decreased with a debit and the revenue account is increased with a credit. Hence, $ 1000 of unearned income will be recognized as service revenue. Service revenue will, in turn, affect the Profit and Loss account in the Shareholders Equity section. As an example, we note that Salesforce.com reports unearned revenue as a liability (current liabilities). A liability account that reports amounts received in advance of providing goods or services.

Well, the short answer is that both terms mean the same thing — that a business has been paid for goods or services it hasn’t provided yet. Here’s a more thorough description of deferred and unearned revenue, as well as a few examples to illustrate it. The seller recognizes “unearned revenues” (or “deferred revenues”) as revenues received for goods and services not yet delivered. To balance the accounting records, the bookkeeper will also make a record in the Cashaccount under assets. The transaction will increase both the Cash and UnearnedRevenue accounts.